Oportun Finacial Organization is a fairly the fresh bank into the scene. The firm recently ran social and got a profitable initial social offering. The organization focuses primarily on unsecured loans, mortgage loans, automobile financing, and you can financial lessons qualities, but there’s things regarding their values which is unique and you may different than a great many other lenders. Its approach to adverts produced you need to learn more about the fresh Oportun and you can immediately following exploring their story, the company profile, in addition to their most recent affairs, i unearthed that that is among the many financial firms that sustain viewing, whether you are looking for financing or if you are an investor trying to diversify their collection. Listed below are 20 things that your don’t find out about Oportun Economic Corporation that you may be glad to learn.

step one. These are generally still an earlier providers

Opportune first opened the doorways getting organization in 2005. They’ve got simply experienced providers getting 14 years, but at that moment, they’ve created a very good reputation on the organizations that they serve. Their listeners try estimated to get to one hundred billion Us customers. They perform for the condition regarding Ca, and you may they’ve went a considerable ways in aiding those who in earlier times don’t qualify for that loan to help you support the necessary funding so you’re able to boost their total well being.

dos. Opportun serves customers who have minimal or no credit history

One of the most book aspects of Opportun is that they have an objective to help people that do not qualify for conventional funds to safer capital to your essentials of lives. It believe clients that maybe not based credit score as well because the people with a limited record. Almost every other loan providers in the popular economic characteristics field would not meet the requirements a number of the readers one to Opportun provides. Their mission instructions each personnel of the organization to work alongside people that are really missing out so you’re able to be eligible for funds hence are appropriate due to their individual items. Hard-working people who are gainfully employed, also individuals with lower to help you average-money membership are believed for automobile, home loan and personal finance which can help these to introduce its credit rating. They give you clients the opportunity to build and you can show its creditworthiness.

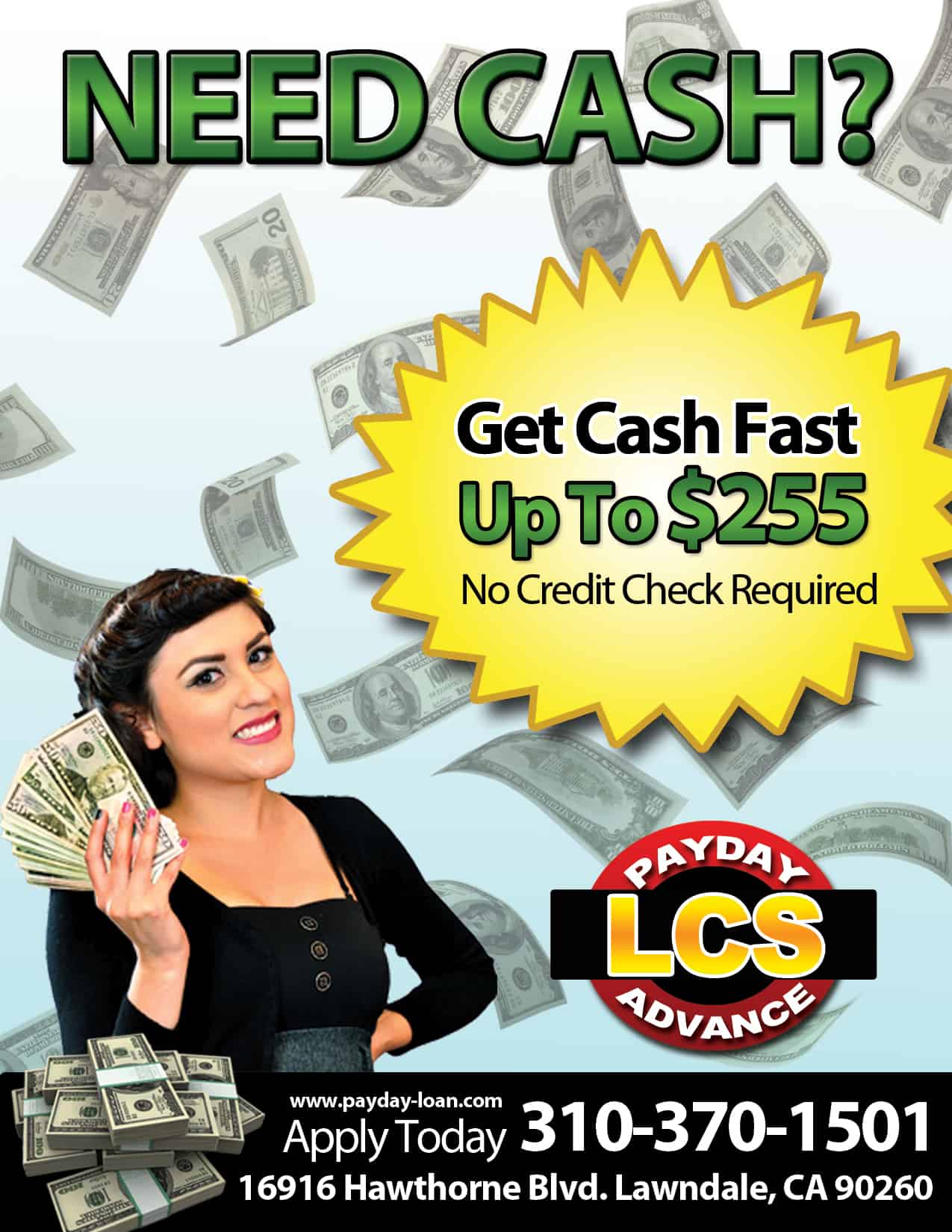

step three. They operate on a separate model

The brand new model one to Opportun spends facilitate reasonable-earnings visitors to end planning solution loan providers which charge astronomically high charge for their economic services. Opportun enjoys their pricing practical and concentrate on providing small-dollar finance which can be reasonable for their users. It is estimated that he’s got helped to save over $1.5 million into the appeal and fees whenever its functions is actually compared to help you option lenders. This might be a considerable amount.

4. Opportun has already established compliment out-of Go out Mag

Big date Mag features named Opportun among the Wizard Companies who’re concerning the company from inventing the long run. For the reason that of one’s innovative and humanitarian means which they take to the fresh Fresno CA no credit check loans delivery off features. FinTech Development entitled Opportun’s personal loans among the best individual financial loans in the industry.

5. They might be nonetheless building and you can improving

This specific business is nonetheless in the process of developing their society and expanding the fresh new type of merchandise which they provide for customers out-of California. They might be however in the process of strengthening its area out of partners, professionals, and users inside a spirit where you work with her to improve this new complete well being. They might be continuously looking the fresh new opportunities because they provide the service that people have to build and you can boost their existence.

6. Raul Vasquez was a ceo with sight

When Raul Vasquez basic stepped-up on plate into the 2012, he had been immediately up against particular tough decisions. Opportun was a student in a dreadful condition and their finances so there is a go which they could have issues deciding to make the payroll. This is eight in years past and since that time, the business turned as much as less than his leadership. He previously new attention to convert the lending company into an effective and you can secure providers, but it try a great amount of dedication.